close

Choose Your Site

Global

Social Media

Views: 0 Author: Site Editor Publish Time: 2025-12-11 Origin: Site

Imagine securing your nation's cable supply without the risks of import dependency, and 4E makes this possible by offering a strategic “one-stop” cable production solution for prospective investors and leaders in the global power industry, especially from emerging markets who aim to establish localized cable manufacturing but lack technical experience and talents or cable industry know-how. Furthermore, the brand 4E is created through an abbreviation of East Energy Electrical Engineering, which embodies our vision to lead the new era of the cable industry. Nowadays, the global electrical industry is facing a significant challenge: countries are experiencing rising import costs, including unstable trade policies, tariffs, and extended delivery times. Consequently, many often struggle to meet electricity development goals due to a reliance on imported cables, leading to significant economic and governmental pressures for localization. 4E’s solution represents a fundamental shift in addressing cable production challenges in emerging markets by providing an integrated turnkey solution that serves as the exclusive conduit to the technical expertise, management, and operational systems of China’s top-tier cable manufacturers. It is not merely a technology transfer, but also seamless migration of an entire production ecosystem, enabling our partners to establish efficient, cost-effective manufacturing capacity without the delays and expenses of independent learning. By delivering a mature and proven operational blueprint, we eliminate the costly trial-and-error phase, thereby ensuring our partners achieve operational efficiency and profitability with unprecedented speed. Furthermore, this Knowledge Export model is globally unique, with no direct competitors offering a comparable end-to-end system. Moreover, each successful collaboration is reinforced by official endorsements from both Chinese and host government trade bodies, positioning every project within a framework of bilateral economic cooperation and solidifying its role as a catalyst for strengthened international partnership. In conclusion, we help countries build localized industrial ecosystems. Each factory we establish could create skilled jobs, develop domestic brands, and form a sustainable supply chain that raises national

productivity and GDP, and there is good reason to believe that by partnering with our company, you are not just buying, but building a nation’s industrial future.

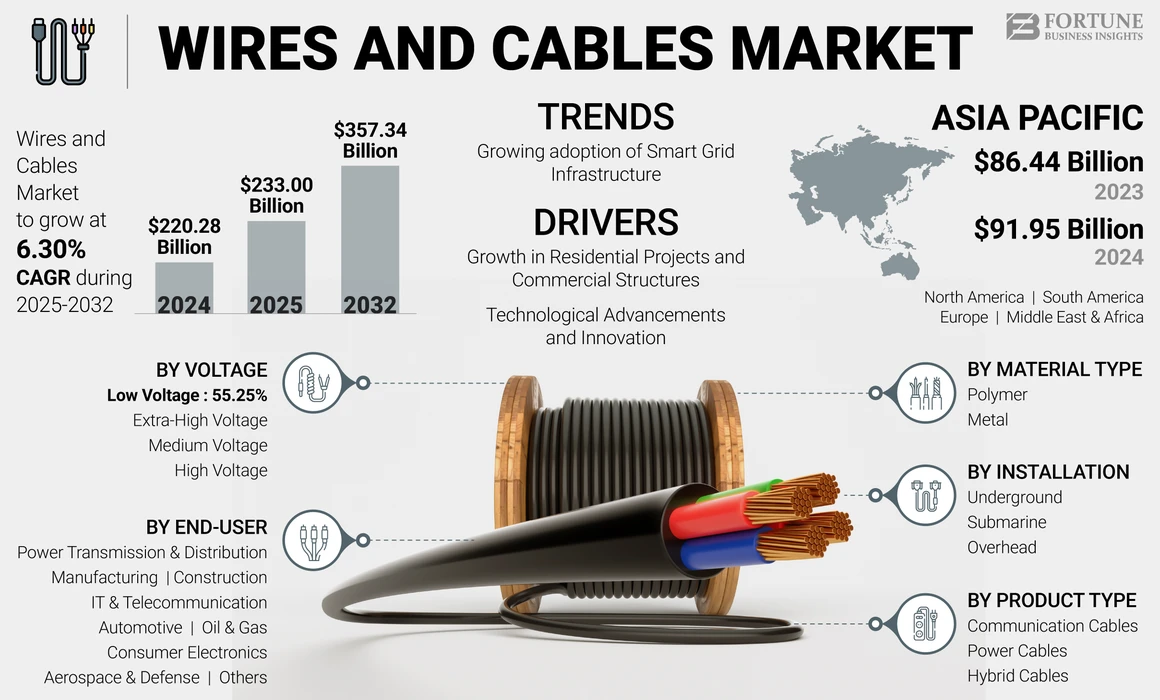

The global cable market's critical fragmentation highlights an urgent need for integrated solutions—a gap 4E fills by providing a one-stop production model that bridges the divide between booming demand and the current reliance on fragile import chains. Specifically, the international market only provides fragmented resources: material suppliers, equipment makers, and testing device producers rather than total solutions. As a result, no single company provides a complete set-up from factory design to production training. This gap leaves well-funded but inexperienced investors unable to compete locally. A compelling case in point is Tanzania in 2021(See Table 1), where a new presidential directive was issued for localization. Nevertheless, after the inauguration of Tanzania’s new president, the government issued a national directive requiring all local EPC contractors to source key materials—cables, transformers, and concrete poles—exclusively from domestic suppliers. This policy change, while promoting localization, created an immediate supply crisis: the EPC projects originally scheduled for completion within three years were still unfinished by 2024. Additionally, the situation was further worsened by the pandemic, which disrupted global logistics, increased raw material prices, and delayed imports. To elucidate how attractive the market is, according to Fortune Business Insights and Gminsights, the global wires and cables market is projected to grow from abuot 250 billion USD to 360 billion USD from 2025 to 2032 (and 560 billion in 2034), exhibiting a CAGR of 6.3%-7.3% annual rate -much faster than capacity expansion. (See Appendix Figure 1-2) Moreover, the growth is fueled by smart-grid upgrades, renewable energy expansion, and rapid urbanization. (Fortune Business Insights, 2025) (Gminsights, 2025-Notwithstanding this accelerating infrastructure investment, many regions still rely heavily on imported cables. Thus, this global trend reveals an urgent need for localized, sustainable cable production—the very gap 4E is designed to fill through its one-stop cable production solutions. This real case highlights not only the opportunity but the urgency of localized cable production worldwide.

Most importantly, our service delivers a full turnkey solution that transforms investors’ capital into operational cable plants. 4E offers full-scale consulting, including factory site selection, plant layout, automation production machines design, online quality testing systems, raw material sourcing, production process design, employee training of testing, manufacturing and packing, and inventory management from fully experienced engineers and management team from our company who have been working the cable sector in top ten Chinese and international Brand for 15-30 years.

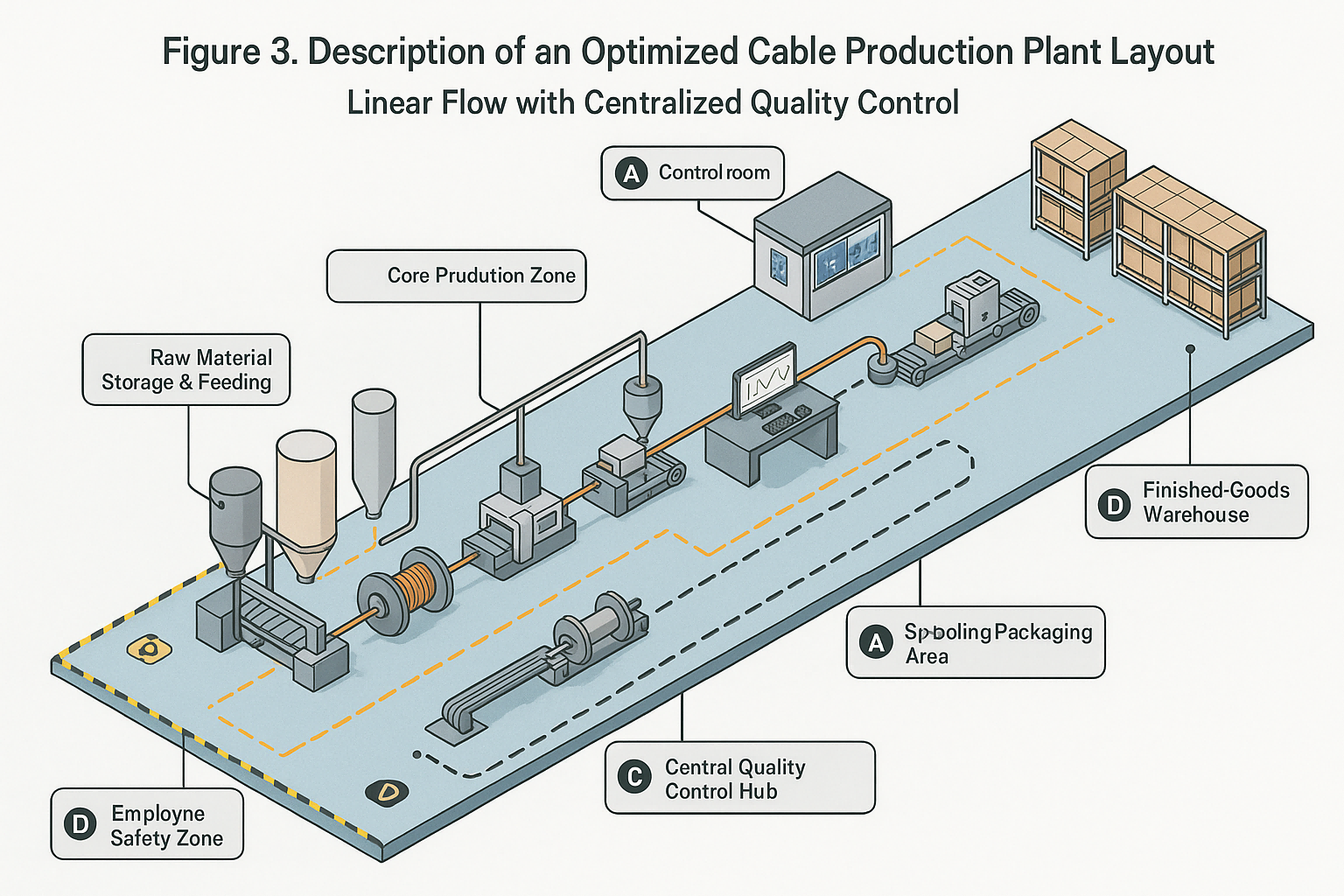

1. Factory Layout & Site Selection: data-based recommendations tailored to market share, logistics, and long-term expansion needs. (see Figure 3)

2. Automation Equipment Design: one-time investments that increase efficiency 300-500% and reduce labor costs by up to 80%.

3. Integrated Online Quality Monitoring: real-time data feedback minimizes human error and enhances safety.

4. Technical and Workforce Training: clients may choose on-site international training or join programs in China until their teams master all operations.

5. Localized Process Guidance: packaging, inventory, and inspection procedures aligned with local regulations and market preferences.

Furthermore, 4E’s uniqueness lies in being solution-oriented rather than production-oriented. We have no factory of our own, thus no conflict of interest. Accordingly, our network of suppliers, former cable engineers, and production experts allows us to secure factory-level prices and trusted quality. In essence, we help clients “learn to produce,” not just “learn to buy.” Ultimately, what differentiates us is integration—a single partner accompanying the investor from concept to completion.

Our target market confidently spans five high-growth major-North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa( see Table 2)—each offering distinct opportunities, and we emphasize collaboration rather than competition, appealing to governments, EPC contractors, and investors who wish to develop long-term, sustainable cable production capacity. In North America, expansion of power transmission systems and increasing smart-grid integration continue to elevate the need for advanced cable solutions. Europe is witnessing sustained demand driven by modernization of existing networks and infrastructure renewal initiatives. Across the Asia Pacific, accelerating industrialization, urban expansion, and clean energy programs are fueling substantial market growth. Latin America demonstrates notable momentum as investments in modern and resilient power systems gain pace, while the Middle East & Africa are experiencing strong traction from sustainable and smart development projects. Collectively, these regions highlight a diverse but convergent trend, the urgent global need for localized cable production, precisely the gap 4E’s one-stop service aims to fill.

4E generates revenue through a flexible, tiered service fee structure (USD 0.5-10 million), with modular pricing that allows clients to select and pay for only the services they need. Specifically:

The Basic Tier ($0.5-3 million) covers essential services including factory site selection, automated production line design, and core staff training.

The Standard Tier ($3-6 million) builds upon the Basic Tier by adding comprehensive quality management systems, supply chain development, and team-building guidance.

The Premium Tier ($6-10 million) further incorporates annual technical operational support, market development guidance, and continuous process improvement services.

Additionally, all packages maintain modular flexibility, allowing clients to customize service components with corresponding price adjustments. Our payment terms follow three clear milestones: 30% upon contract signing, 40% after design confirmation, and the remaining 30% upon project commissioning and launch. This phased approach ensures adequate startup capital while securing progressive commitment throughout project implementation. To commercialize 4E's integrated solution, we have established targeted marketing channels. Digitally, we focus on B2B industry platforms and search engine marketing, while physically we prioritize participation in international trade shows and developing partnerships with Chinese and foreign economic and trade institutions. This combined strategy systematically builds brand credibility while leveraging official channels to efficiently connect with our target clients. According to our detailed financial analysis, mid-scale cable plants implementing our solution typically achieve investment payback within 18-24 months. This compelling ROI, driven primarily by automation efficiencies and localized production savings, forms the fundamental rationale behind our service pricing strategy.

Our marketing strategy positions 4E not as a vendor, but as a strategic partner in building power infrastructure within emerging markets. For example, we build credibility by publishing industry white papers based on real-world cases, like our Tanzania success story, and by co-hosting investment seminars with official bodies like the China Council for the Promotion of International Trade. This "authority marketing" is targeted directly at government ministries and investors through dedicated channels, complemented by direct engagement with industry leaders on professional platforms like LinkedIn. Moreover, our messaging is designed to resonate emotionally, transforming our case studies into compelling narratives of how clients can avoid costly failures and achieve rapid market leadership.

Operationally, this promise is delivered through a robust "turnkey" system. Each client is assigned a dedicated Project Manager who serves as a single point of contact, ensuring clarity and efficiency. Furthermore, our service delivery blends our standardized, proven modules with careful localization to meet specific regional requirements. This process is managed by a hybrid team of seasoned cable industry experts and dynamic, bilingual operational specialists. Ultimately, the entire operation is structured around transparent, milestone-based phases—mirroring our payment schedule, which keeps projects on track, aligns interests, and builds trust by demonstrating tangible progress at every step.

In conclusion, 4E presents a definitive solution to one of the most pressing challenges in global power infrastructure development. While nations worldwide face urgent pressure to establish localized cable production, the existing market fails to provide the integrated expertise needed to transform this vision into an operational reality. Our unique "Knowledge Export" model directly bridges this gap by delivering China's proven cable manufacturing ecosystem—from veteran engineers to optimized processes—directly to emerging markets. We don't just build factories, we also transfer complete capability, enabling partners to achieve in 18-24 months what would otherwise take years of costly trial and error. Therefore, by combining economic viability with strategic bilateral partnerships, 4E isn't merely offering a service—we're establishing a new paradigm for sustainable industrial development in the global power sector. We cordially invite you to join us in building this new era. Let’s empower cable production from within each country & create shared prosperity!

Layout Concept: "Linear Flow with Centralized Quality Control"

The proposed layout is engineered for maximum efficiency and minimal handling, embodying the automation and process control we promise. Raw materials (copper strands, polymer pellets) are received at one end of the facility. The production flow then moves linearly through successive, integrated zones:

Raw Material Storage & Feeding: Equipped with automated conveyor systems.

Core Production Zone: Housing drawing, annealing, and stranding machines.

Insulation & Sheathing Line: Featuring extruders connected to centralized raw material silos.

Central Quality Control Hub: Positioned mid-line for real-time monitoring of cable diameter, integrity, and electrical properties.

Spooling & Packaging Area: Automated spooling and packaging stations.

Finished Goods Warehouse: With organized racking for direct outbound shipping.

A. Automated Guided Vehicle (AGV) Paths: For material movement between stages.

B. Control Room: Overlooking the entire production floor for centralized oversight.

C. In-line Testing Points: Integrated within the production flow for 100% product testing.

D. Employee Safety Zones: Clearly marked, highlighting our commitment to operational safety.

This layout is a physical manifestation of our "proven operational blueprint." It minimizes bottlenecks, reduces manual labor, and ensures a seamless transition from raw material to finished, certified product, directly contributing to the promised 300-500% efficiency gains.

Phase | Timeline | Key Activities & Milestones |

1. Policy Shift | Q1 2021 | New presidential directive mandates local sourcing for EPC projects. |

2. Supply Crisis | 2021-2023 | Project delays accumulate; import costs soar by 30-40%. |

3. 4E Engagement | Q1 2023 | Feasibility study & contract signing with investor. |

4. Plant Setup | Q2 2023 - Q1 2024 | 4E executes: Factory design, equipment procurement, staff training in both Tanzania and China. |

5. Production Launch | Q2 2024 | First cable produced locally; quality certification obtained. |

6. Market Impact | H2 2024 | Becomes primary local supplier; reduces delivery time from 3 months to 2 weeks. |

Regions | North America | Europe | Asia Pacific | Latin America | Middle East & Africa |

Countries of the Region | the USA and Canada | UK, Germany, France, Italy, Spain, Russia and Rest of Europe | Japan, China, India, Australia, Southeast Asia and Rest of Asia Pacific | Brazil, Mexico, and Rest of Latin America | South Africa, GCC, and Rest of the Middle East & Africa |

1. Forturn Business Insights. Cables & Accessories Market Size, Share and Global Trend By Voltage (Low, Medium, High), By Installation (Overhead Cables and Accessories, Underground Cables & Accessories), By End-User (Commercial & Residential, Transportation, Utilities, Oil & Gas, Mining & Metals, Chemical & Petrochemicals, Renewables, Others), and Regional Forecast, 2025-2032, Oct. 18, 2025, https://www.fortunebusinessinsights.com/industry-reports/cables-accessories-market-101077

2. Forturn Business Insights. Wires and Cables Market Size, Share & Industry Analysis, By Material Type (Metal and Polymer), By Product Type (Power Cables, Hybrid Cables, and Communication Cables), By Installation (Overhead, Underground, and Submarine), By Voltage (Low Voltage, Medium Voltage, High Voltage, and Extra-High Voltage), By End-User (Aerospace & Defense, Construction, IT & Telecommunication, Power Transmission & Distribution, Oil & Gas, Consumer Electronics, Manufacturing, Automotive, and Others), and Regional Forecast, 2025–2032, Oct. 28, 2025, https://www.fortunebusinessinsights.com/wires-and-cables-market-103322

3. Gminsights. (2025, February). *Wire and Cable Market Size - By Product, By Voltage, By Application Analysis & Forecast, 2025 - 2034* (Report ID: GMI4859). Retrieved October 28, 2025, from https://www.gminsights.com/industry-analysis/wire-and-cable-market